HFblogNews

Профессионал

Date : 8th June 2022.

Market Update – June 8 – Wait & See Mode Ahead of US Inflation.

USD moved lower at close but is currently retaking the 102.50 level. Stocks also higher into close (NASDAQ over 1%) on retailers and energy stocks, Yields cooled (10yr below 3%), Oil rallied over 1% to 13-week high on tight supply from private inventories. Yellen persistent high inflation “Unacceptable”. Demand for the safety of Treasuries picked up after the World Bank slashed its global growth forecast by nearly a third to 2.9% for 2022, warning that Russia’s invasion of Ukraine has compounded the damage from the COVID-19 pandemic, and many countries now face recession. In Asia, a rally in Chinese tech stocks that followed a batch of game approvals helped to keep stock market sentiment supported overnight, and the Hang Seng has gained nearly 2% so far. The CSI 300 is up 0.4%, while ASX and Nikkei lifted 0.4% and 1.0% respectively.

Overnight – JPY GDP beat (-0.1% vs. -0.3%) & Economic Watchers Sentiment better (54.0 vs 51.9), CHF Unemployment in line (2.2%) but German Industrial Production missed significantly (0.7% vs 1.3%).

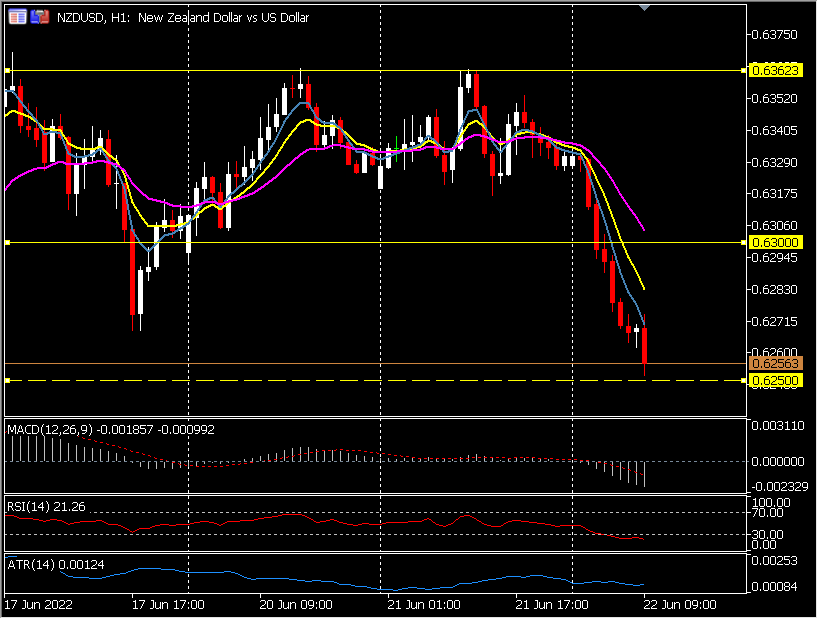

Biggest FX Mover @ (06:30 GMT) Sugar (-3%). Dipped below 20- and 50-day SMA. Next key support at 18.60 from the Weekly Chart. H1 MAs aligning lower, MACD histogram sharply down, RSI 24, OS & declining, H1 ATR 0.12, Daily ATR 0.38.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Market Update – June 8 – Wait & See Mode Ahead of US Inflation.

USD moved lower at close but is currently retaking the 102.50 level. Stocks also higher into close (NASDAQ over 1%) on retailers and energy stocks, Yields cooled (10yr below 3%), Oil rallied over 1% to 13-week high on tight supply from private inventories. Yellen persistent high inflation “Unacceptable”. Demand for the safety of Treasuries picked up after the World Bank slashed its global growth forecast by nearly a third to 2.9% for 2022, warning that Russia’s invasion of Ukraine has compounded the damage from the COVID-19 pandemic, and many countries now face recession. In Asia, a rally in Chinese tech stocks that followed a batch of game approvals helped to keep stock market sentiment supported overnight, and the Hang Seng has gained nearly 2% so far. The CSI 300 is up 0.4%, while ASX and Nikkei lifted 0.4% and 1.0% respectively.

Overnight – JPY GDP beat (-0.1% vs. -0.3%) & Economic Watchers Sentiment better (54.0 vs 51.9), CHF Unemployment in line (2.2%) but German Industrial Production missed significantly (0.7% vs 1.3%).

- USDIndex dipped to 102.24 after Target Corp warned about excess inventory and said it would cut prices, offering some relief to those who think inflation may be peaking.

- Equities – CSI 300 is up 0.4%, while ASX and Nikkei lifted 0.4% and 1.0% respectively. GER40 and UK100 futures are posting gains of 0.3% and 0.2% respectively.

- Yields 10-year yield below the 3% mark helped extend the drop in yields.

- USOIL spiked to $120.35 – low oil inventories, Goldman Sacks – “we now forecast that Brent prices will need to average $135/bbl in 2H22-1H23 (up $10/bbl vs. prior forecast) for inventories to finally normalize by late 2023, the binding constraint to prices in our view. This represents summer retail prices reaching levels normally associated with $160/bbl crude prices”. The CEO of global commodities trader Trafigura said oil prices could soon hit $150 a barrel and go higher this year, with demand destruction likely by the end of the year.

- Bitcoin down to $30320 area now.

- FX markets – USD is continuing its ascent and USDJPY is above 133.53. EURUSD is slightly below 1.07 and Cable is at 1.2560.

Biggest FX Mover @ (06:30 GMT) Sugar (-3%). Dipped below 20- and 50-day SMA. Next key support at 18.60 from the Weekly Chart. H1 MAs aligning lower, MACD histogram sharply down, RSI 24, OS & declining, H1 ATR 0.12, Daily ATR 0.38.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.