HFblogNews

Профессионал

Date 3rd August 2023.

Market Update – August 3 – 48 sessions later, the BOJ’s weak heart, BOE, AAPL & AMZN await.

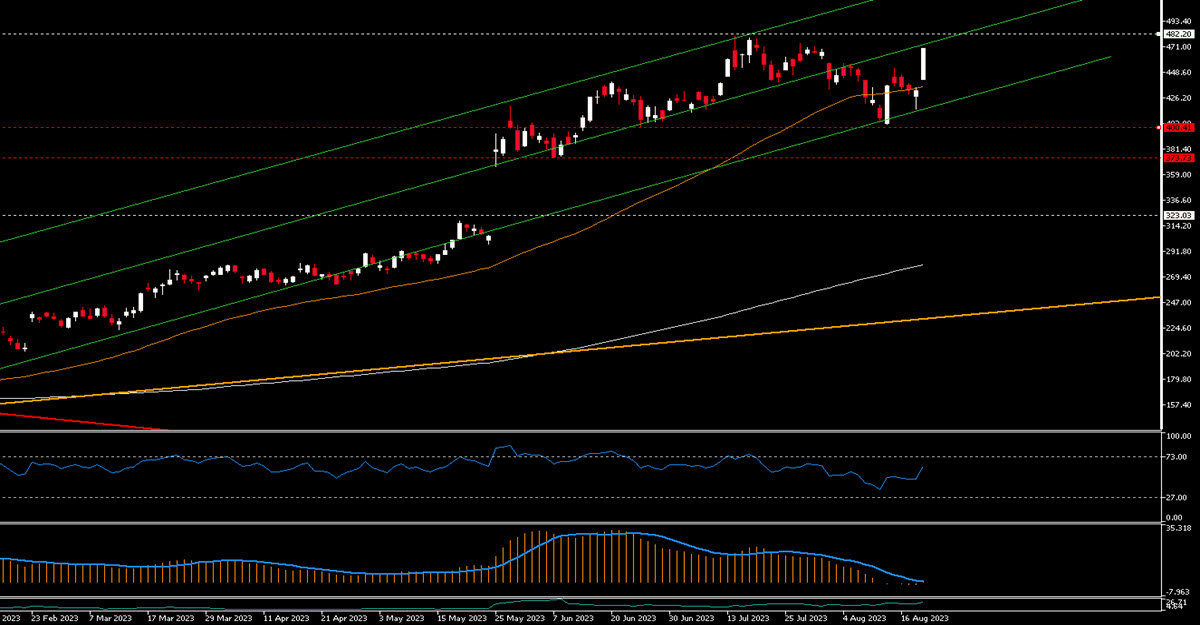

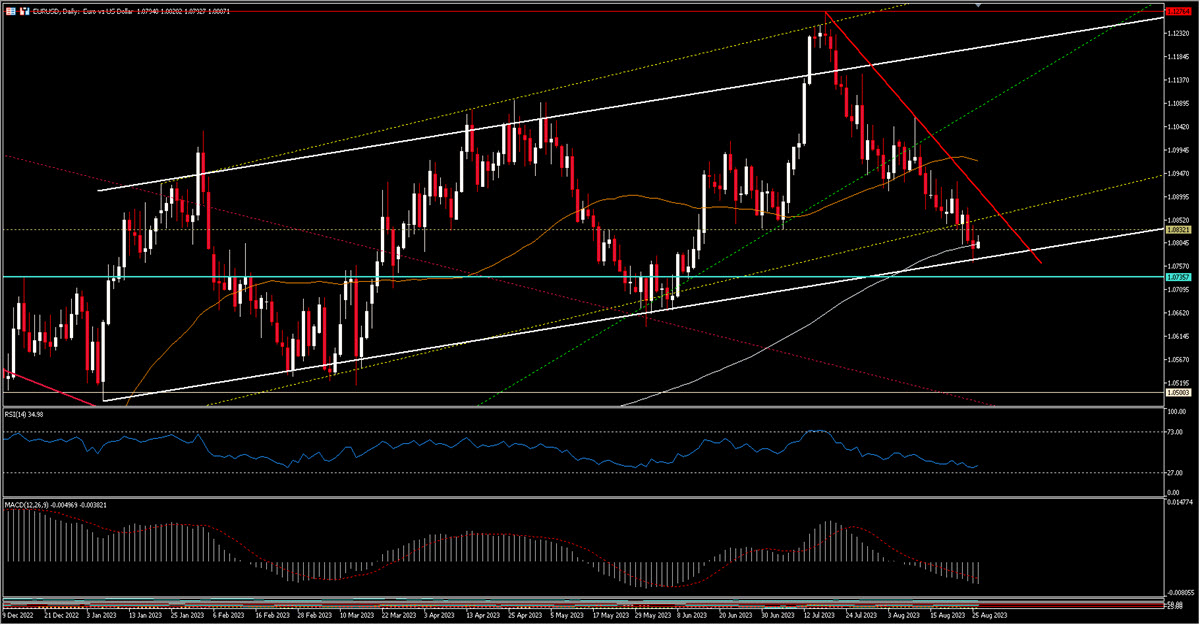

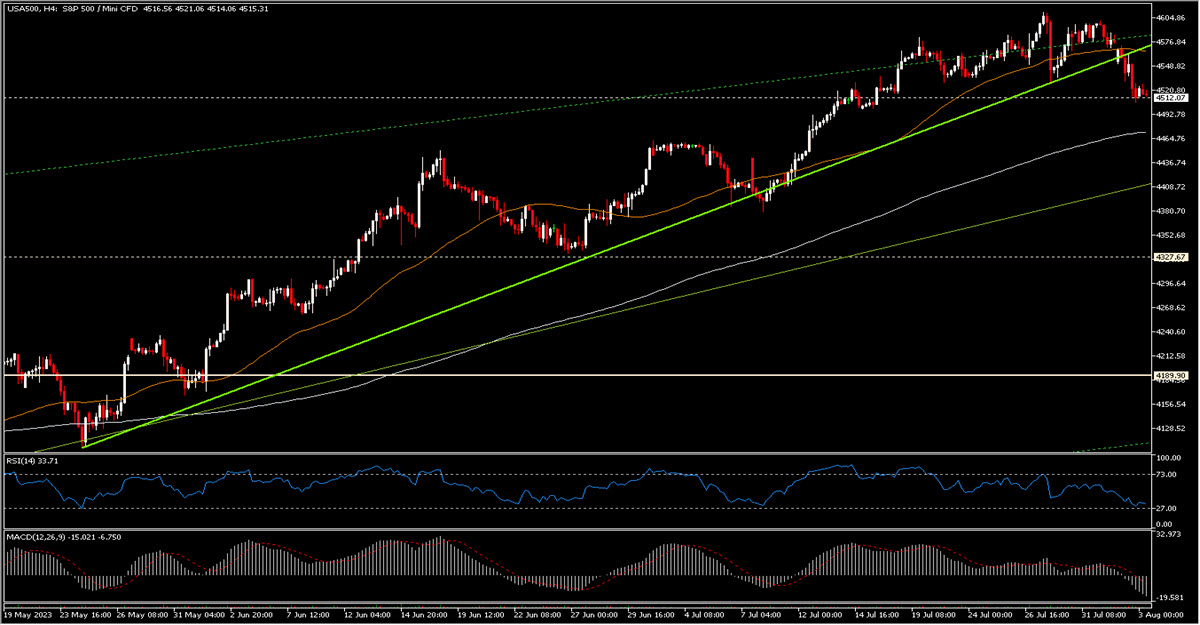

48 sessions: this is how long it has been since the last time the US500 was down more than 1%, on 23 May. Fitch’s downgrade was a good excuse to sell a probably expensive market and the US100 fell 2.21%. Rates were sold, especially on the long end (the 10y) which led to a steepening of the curve again (the 2y10y is now at -77 bps): this is a classic where the movement comes not from a change in the outlook for growth, inflation etc but from a (minimal) ”increase” in country risk. Currently only Moody’s retains the AAA qualification. Admittedly, a much higher than expected ADP figure helped the selling pressure on bonds (+324k vs. +189k expected) but let’s not be under any illusions about the NFP: it has long proved to be a poor forecaster.

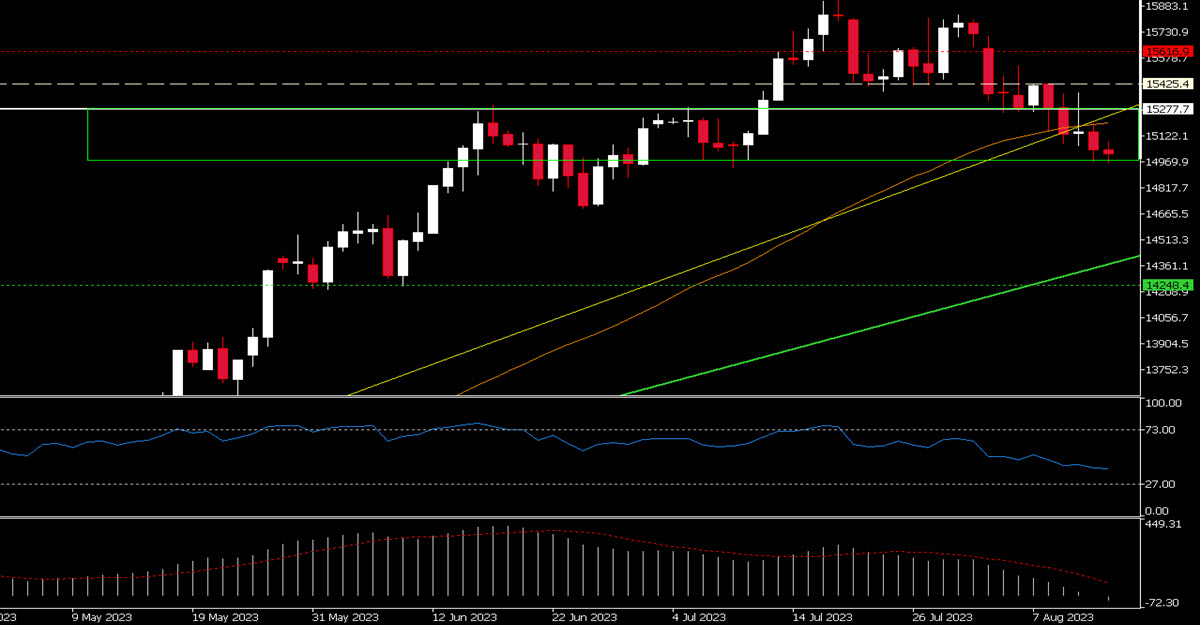

US500, H4

Overnight the BOJ implemented its second unscheduled bond buying intervention as the JPY sank again. Later we will also have the BOE’s decision, which is expected to make a difficult choice between a 50 bps increase or perhaps 25 bps with a focus on more quantitative tightening. Interestingly, the easing cycle started in South America and then Chile, while Brazil also cut 50 bps yesterday, more than expected. Finally, let us not forget the big names that will report tonight, Amazon and Apple: for the former the options market is pricing an implied movement of 5.9% after the results, for the latter only 1.59%.

Biggest Mover: (@6:30 GMT) Coffee (+1.64%) trading at 167.45, continues the upward move from the $154.5 support, RSI positively sloped at 55.51, MACD still negative but moving north.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Marco Turatti

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Market Update – August 3 – 48 sessions later, the BOJ’s weak heart, BOE, AAPL & AMZN await.

48 sessions: this is how long it has been since the last time the US500 was down more than 1%, on 23 May. Fitch’s downgrade was a good excuse to sell a probably expensive market and the US100 fell 2.21%. Rates were sold, especially on the long end (the 10y) which led to a steepening of the curve again (the 2y10y is now at -77 bps): this is a classic where the movement comes not from a change in the outlook for growth, inflation etc but from a (minimal) ”increase” in country risk. Currently only Moody’s retains the AAA qualification. Admittedly, a much higher than expected ADP figure helped the selling pressure on bonds (+324k vs. +189k expected) but let’s not be under any illusions about the NFP: it has long proved to be a poor forecaster.

US500, H4

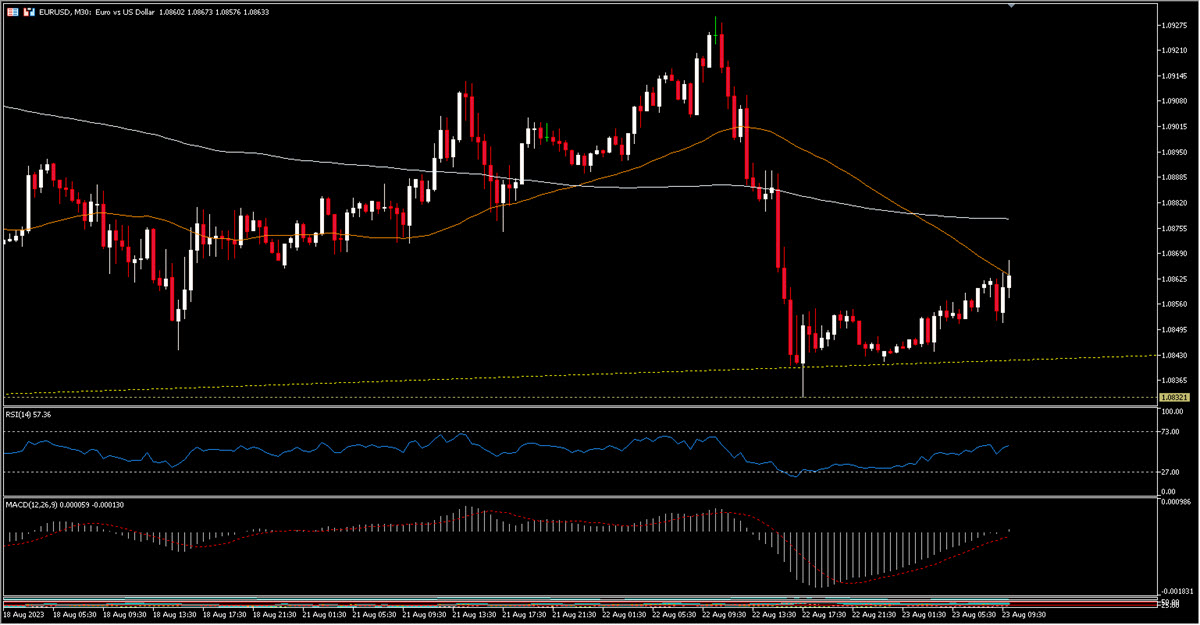

Overnight the BOJ implemented its second unscheduled bond buying intervention as the JPY sank again. Later we will also have the BOE’s decision, which is expected to make a difficult choice between a 50 bps increase or perhaps 25 bps with a focus on more quantitative tightening. Interestingly, the easing cycle started in South America and then Chile, while Brazil also cut 50 bps yesterday, more than expected. Finally, let us not forget the big names that will report tonight, Amazon and Apple: for the former the options market is pricing an implied movement of 5.9% after the results, for the latter only 1.59%.- FX – USDJPY is up to 143.88 on a sinking Yen, further dragging down the USD Index that stays at 102.60 now. EUR and GBP are little moved while AUDUSD and NZDUSD sank to 0.6535 and 0.6073 respectively.

- Stocks – US Futures are slightly up (0.1%) this morning after yesterday’s sell off. China50 +0.78%, JPN225 -0.94%. Qulacomm slipped nearly -7% after hours after missing on fiscal 3rd quarter revenue and guidance for the current period.

- Commodities – USOil suffered some selling pressure as did the overall market yesterday (-2.95%) and is now trading at $79.59, Copper at $385.15.

- Gold – flat this morning after having retreated to $1934, XAG at $23.66.

Biggest Mover: (@6:30 GMT) Coffee (+1.64%) trading at 167.45, continues the upward move from the $154.5 support, RSI positively sloped at 55.51, MACD still negative but moving north.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Marco Turatti

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.