HFblogNews

Профессионал

Date 13th December 2023.

The UK Economy Unexpectedly Contracts! US Inflation Remains Stubborn.

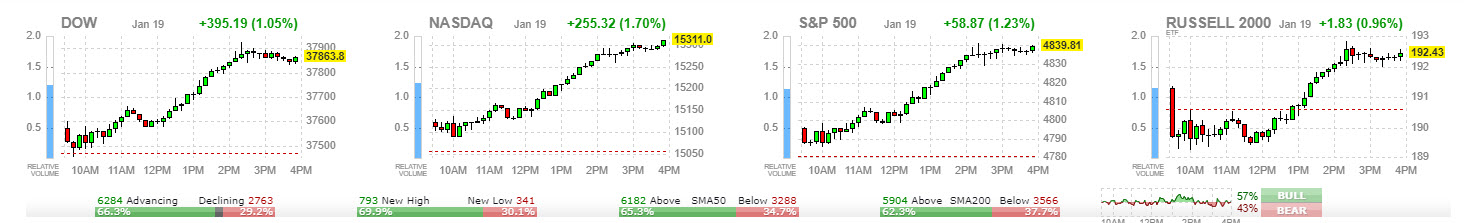

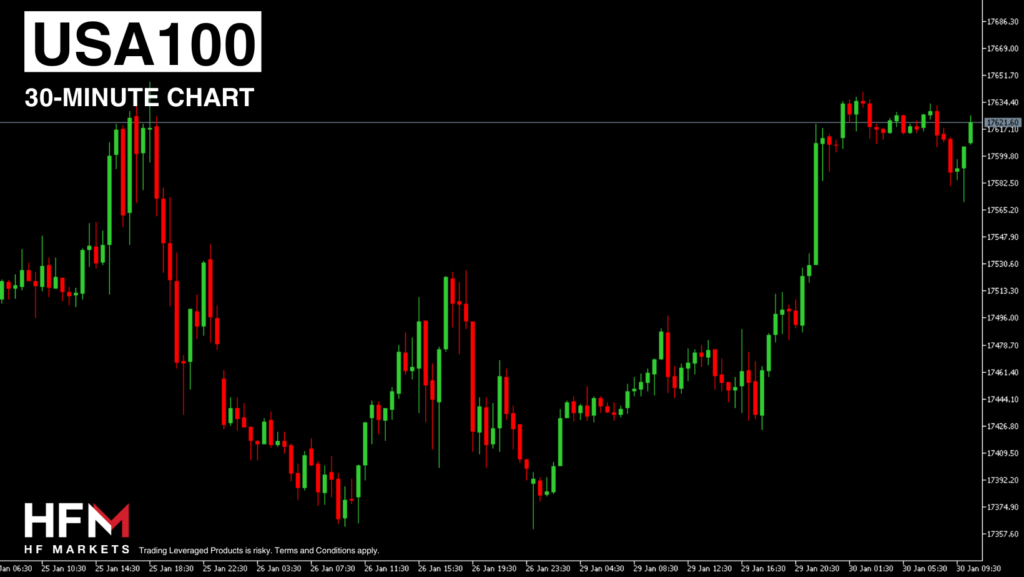

The USA100 continues to be the best performing index, increasing by 0.90% and more than 50% in 2023 in total. The main price driver was the US inflation data which more or less read as per expectations. The US inflation rate has declined from 3.2% to 3.1% but the core inflation rate remains stubbornly high. Core Inflation has remained at 4.00% for a second consecutive month. According to analysts, inflation is not low enough to prompt a pivot in the first quarter of 2024. However, investors are increasing exposure to the stock market as a “soft landing” becomes more likely.

US30 Remains in the “Trend Zone” of Technical Analysis!

Even though the best-performing asset by far is the USA100, the asset experiencing the best performance in terms of components is the US30. The USA100 saw 68% of its stocks increase in value whereas 73% of the US30 appreciated. Investors should also note that of the top 20 influential assets within the US30, only 1 stock declined. Chevron fell by 1.28%, and the best performing stock was Salesforce, rising 1.73%. In comparison, of the top 20 influential stocks within the USA100, 5 stocks declined.

As mentioned above, inflation read as most analysts were expecting, however it did not show any real signs of easing significantly over the next 2-3 months. The Federal Reserve policy makers will be able to discuss monetary policy issues tonight at 18:00 GMT. Journalists will without doubt ask Chairman Jerome Powell if he believes interest rates will be cut in the first half of the year. Without a dovish tone or a clear indication of a cut, the stock market may struggle to maintain momentum. However, most buyers are now investing, not due to a dovish policy, but due to the resilient economy and the likelihood of a soft landing.

One of the few stocks within the Dow Jones which have struggled is Procter and Gamble (holds a weight of 2.64%). Analysts expect the company’s revenue and earnings per share to remain stable, but shareholders have taken badly to the company decision to withdraw from certain countries where the Dollar is now too expensive. For example, the products will be withdrawn from Nigeria and Argentina. Furthermore, Berkshire Hathaway has also advised they have recently sold their shares in the company. Warren Buffet explained that the consumer goods market is recovering too slowly after the pandemic.

In terms of Technical Analysis, the price of the US30 is forming a downward facing retracement but is not showing any signs of strong momentum. Due to the weak momentum, and also bullish impulse waves forming, the instrument continues to remain in bullish territory. The price also continues to trade within the upper side of the Bollinger Bands and Regression Channels, again indicating bullish price movement. However, some traders may be concerned about the high price. These individuals may wait for a lower price or a larger retracement before speculating an increase.

The price throughout the day will be influenced by the Producer Price Index, which looks at inflation at the producer level. If the PPI reads lower than expected (0.2%), the Dow Jones could obtain short-term support. However, the main event will be tonight’s Federal Reserve Press Conference.

GBPUSD – The UK Economy Unexpectedly Contracts!

The price of the GBPUSD came under pressure this morning from the UK’s latest Gross Domestic Product. The UK’s GDP was expected to decline from 0.2% to -0.1%. However, the figure fell to -0.3%, the lowest since September 2023, sparking some doubt as to whether the BoE can hold rates “higher for longer”.

November’s poor GDP figures will not be enough to worry the Bank of England, however, December and January’s GDP figure will now become more vital! If next month’s data also disappoints, investors may start to price in a weaker monetary policy.

The US Dollar Index this morning is slightly higher but has not crossed above yesterday’s highs. However, the Pound is declining against all its main competitors. If the US Producer Price Index reads higher than expected, the Dollar could receive some much-needed support. In this case, the GBPUSD may decline further and break below the support level at 1.25130. In terms of technical analysis, the GBPUSD is trading below the 75-bar exponential moving average and at 42.00% on the RSI. Both indicate sellers are controlling the price movement and a downward trend remains a possibility.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

The UK Economy Unexpectedly Contracts! US Inflation Remains Stubborn.

The USA100 continues to be the best performing index, increasing by 0.90% and more than 50% in 2023 in total. The main price driver was the US inflation data which more or less read as per expectations. The US inflation rate has declined from 3.2% to 3.1% but the core inflation rate remains stubbornly high. Core Inflation has remained at 4.00% for a second consecutive month. According to analysts, inflation is not low enough to prompt a pivot in the first quarter of 2024. However, investors are increasing exposure to the stock market as a “soft landing” becomes more likely.

US30 Remains in the “Trend Zone” of Technical Analysis!

Even though the best-performing asset by far is the USA100, the asset experiencing the best performance in terms of components is the US30. The USA100 saw 68% of its stocks increase in value whereas 73% of the US30 appreciated. Investors should also note that of the top 20 influential assets within the US30, only 1 stock declined. Chevron fell by 1.28%, and the best performing stock was Salesforce, rising 1.73%. In comparison, of the top 20 influential stocks within the USA100, 5 stocks declined.

As mentioned above, inflation read as most analysts were expecting, however it did not show any real signs of easing significantly over the next 2-3 months. The Federal Reserve policy makers will be able to discuss monetary policy issues tonight at 18:00 GMT. Journalists will without doubt ask Chairman Jerome Powell if he believes interest rates will be cut in the first half of the year. Without a dovish tone or a clear indication of a cut, the stock market may struggle to maintain momentum. However, most buyers are now investing, not due to a dovish policy, but due to the resilient economy and the likelihood of a soft landing.

One of the few stocks within the Dow Jones which have struggled is Procter and Gamble (holds a weight of 2.64%). Analysts expect the company’s revenue and earnings per share to remain stable, but shareholders have taken badly to the company decision to withdraw from certain countries where the Dollar is now too expensive. For example, the products will be withdrawn from Nigeria and Argentina. Furthermore, Berkshire Hathaway has also advised they have recently sold their shares in the company. Warren Buffet explained that the consumer goods market is recovering too slowly after the pandemic.

In terms of Technical Analysis, the price of the US30 is forming a downward facing retracement but is not showing any signs of strong momentum. Due to the weak momentum, and also bullish impulse waves forming, the instrument continues to remain in bullish territory. The price also continues to trade within the upper side of the Bollinger Bands and Regression Channels, again indicating bullish price movement. However, some traders may be concerned about the high price. These individuals may wait for a lower price or a larger retracement before speculating an increase.

The price throughout the day will be influenced by the Producer Price Index, which looks at inflation at the producer level. If the PPI reads lower than expected (0.2%), the Dow Jones could obtain short-term support. However, the main event will be tonight’s Federal Reserve Press Conference.

GBPUSD – The UK Economy Unexpectedly Contracts!

The price of the GBPUSD came under pressure this morning from the UK’s latest Gross Domestic Product. The UK’s GDP was expected to decline from 0.2% to -0.1%. However, the figure fell to -0.3%, the lowest since September 2023, sparking some doubt as to whether the BoE can hold rates “higher for longer”.

November’s poor GDP figures will not be enough to worry the Bank of England, however, December and January’s GDP figure will now become more vital! If next month’s data also disappoints, investors may start to price in a weaker monetary policy.

The US Dollar Index this morning is slightly higher but has not crossed above yesterday’s highs. However, the Pound is declining against all its main competitors. If the US Producer Price Index reads higher than expected, the Dollar could receive some much-needed support. In this case, the GBPUSD may decline further and break below the support level at 1.25130. In terms of technical analysis, the GBPUSD is trading below the 75-bar exponential moving average and at 42.00% on the RSI. Both indicate sellers are controlling the price movement and a downward trend remains a possibility.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.