HFblogNews

Профессионал

Date: 13th November 2023.

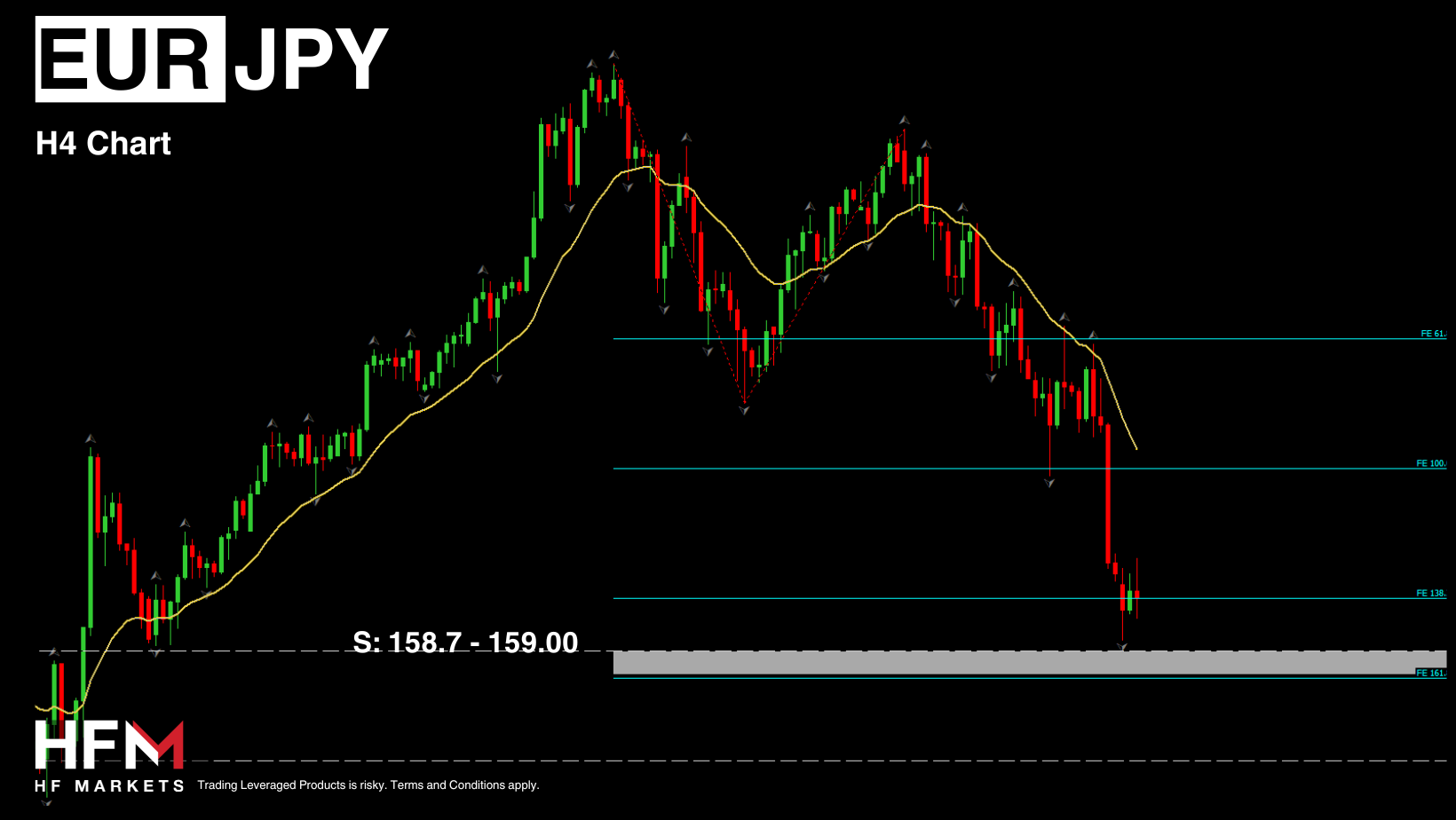

Market Update – November 13 – Pivotal week ahead.

Trading Leveraged Products is risky

It’s the day before a possible Government shutdown again, and a pretty pivotal week ahead for company reports and a round of significant inflation data. Asian stock markets traded mixed overnight. Wall Street closed with a strong rally last week, but with investors waiting for key US inflation numbers, sentiment was mixed.

Late Friday, Moody’s trimmed the outlook on the US credit rating to negative from stable. The factors behind the change included the view that downside risks to the country’s fiscal strength have increased and may no longer be fully offset by the sovereign’s unique credit strengths. It did not help that Congress is again battling to prevent a partial government shutdown. Meanwhile, Moody’s also affirmed the AAA rating, noting it expects the US to “retain its exceptional economic strength” and it suggested “further positive growth surprises over the medium term could at least slow the deterioration in debt affordability.”

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Market Update – November 13 – Pivotal week ahead.

Trading Leveraged Products is risky

It’s the day before a possible Government shutdown again, and a pretty pivotal week ahead for company reports and a round of significant inflation data. Asian stock markets traded mixed overnight. Wall Street closed with a strong rally last week, but with investors waiting for key US inflation numbers, sentiment was mixed.

Late Friday, Moody’s trimmed the outlook on the US credit rating to negative from stable. The factors behind the change included the view that downside risks to the country’s fiscal strength have increased and may no longer be fully offset by the sovereign’s unique credit strengths. It did not help that Congress is again battling to prevent a partial government shutdown. Meanwhile, Moody’s also affirmed the AAA rating, noting it expects the US to “retain its exceptional economic strength” and it suggested “further positive growth surprises over the medium term could at least slow the deterioration in debt affordability.”

- USDIndex held at 2-day bottom, at 105.60.

- USDJPY: Hit new 1 year high, at 151.80 amid wider weakness in the Yen.

- Japanese wholesale inflation slowed below 1% for the first time in just over 2-1/2-years in October, a sign that cost push pressures that had been driving up prices for a wide range of goods were starting to fade. The slowdown in commodity-led inflation is in line with the Bank of Japan’s projections, and puts the spotlight on whether wages and household spending would increase enough to generate a demand-driven rise in consumer prices.

- Stocks: The Hang Seng outperformed, and European futures are also making headway, while US futures are in the red. Bonds declined across Asia, but Treasuries have pared overnight losses, and the US 10-year rate is down -1.2 bp at 4.64%, while the German 10-year yield is up 0.4 bp, and the Gilt yield down -0.1 bp.

- Oil gapped down on the open, reversing partial gains from Friday’s rally, but holds above $76. Any further renewed concerns over waning demand in the United States and China could dent market sentiment.

- Gold remains below $1,950 an ounce but is seeing a positive start to the week as investors react to Moody’s negative outlook on US debt but also as focus turns on US inflation for more cues on the Fed outlook.

- Palladium hovering near 5-year lows.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.