HFblogNews

Профессионал

Date : 19th December 2022.

Market Update – December 19 – Covid outweighs Reopening.

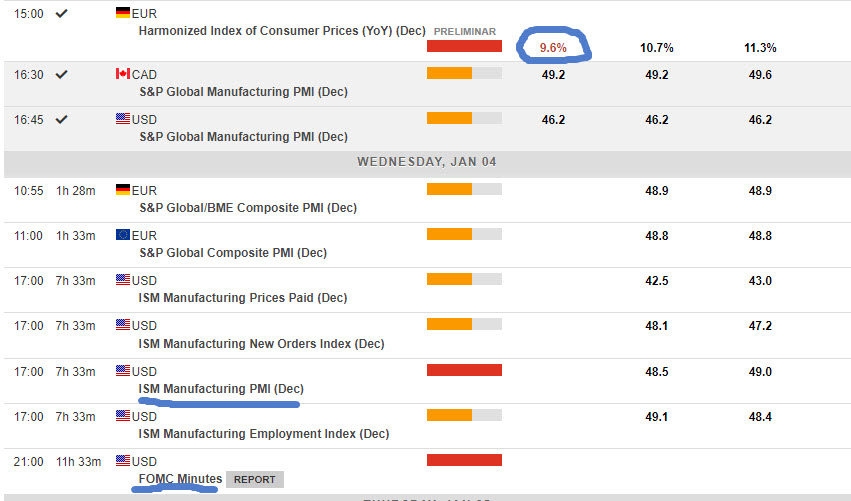

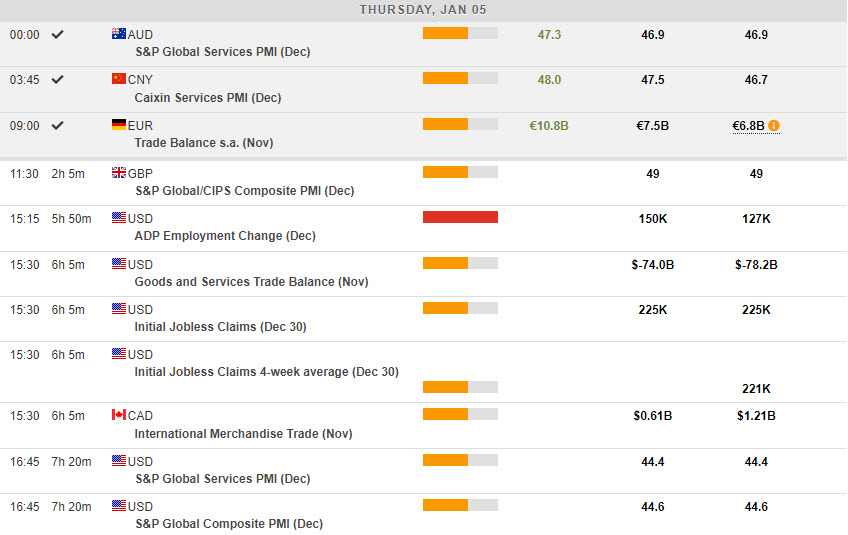

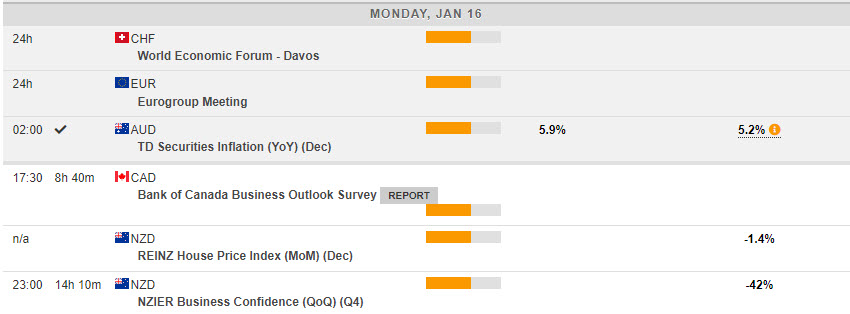

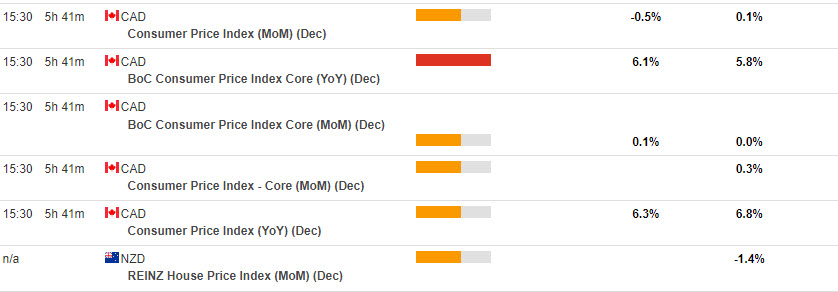

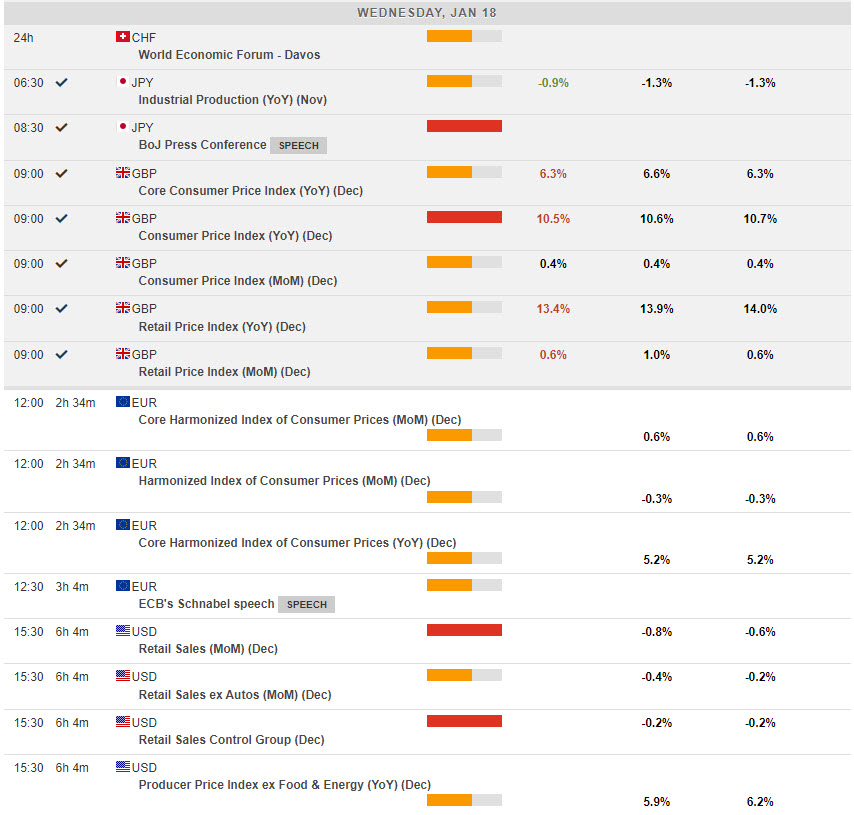

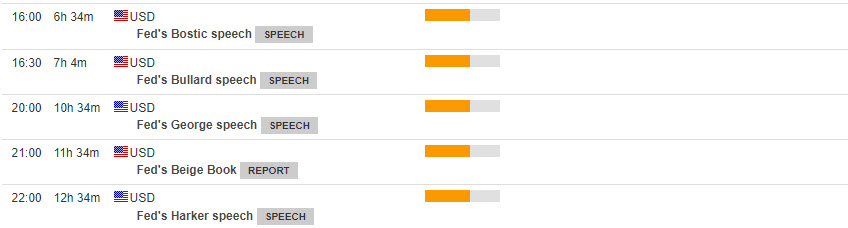

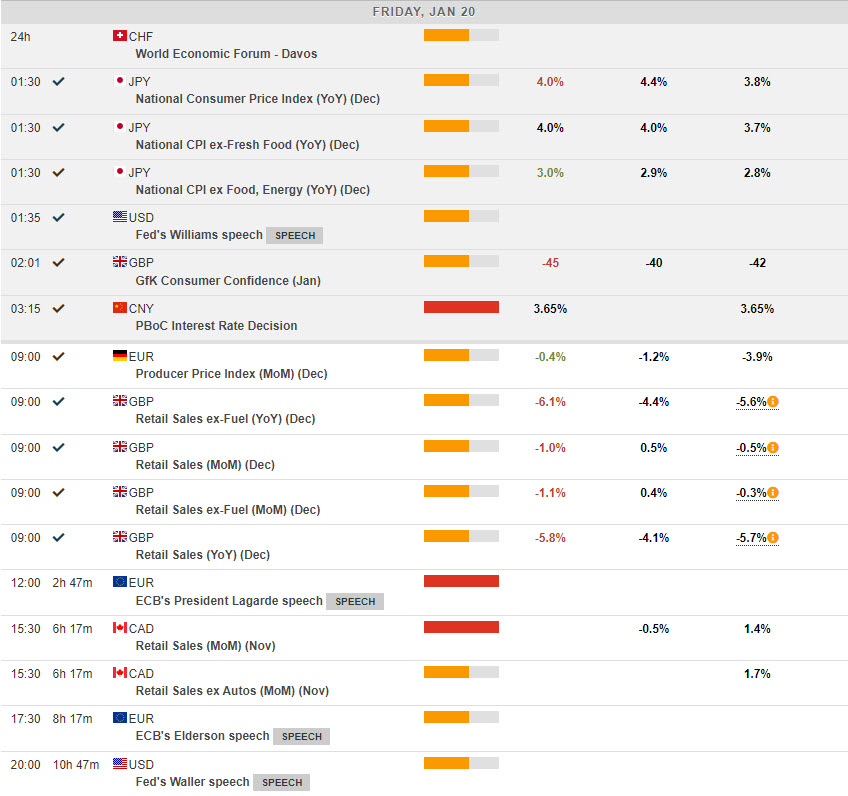

Today: Germany Dec .Ifo survey, Eurozone Q3 labour market!

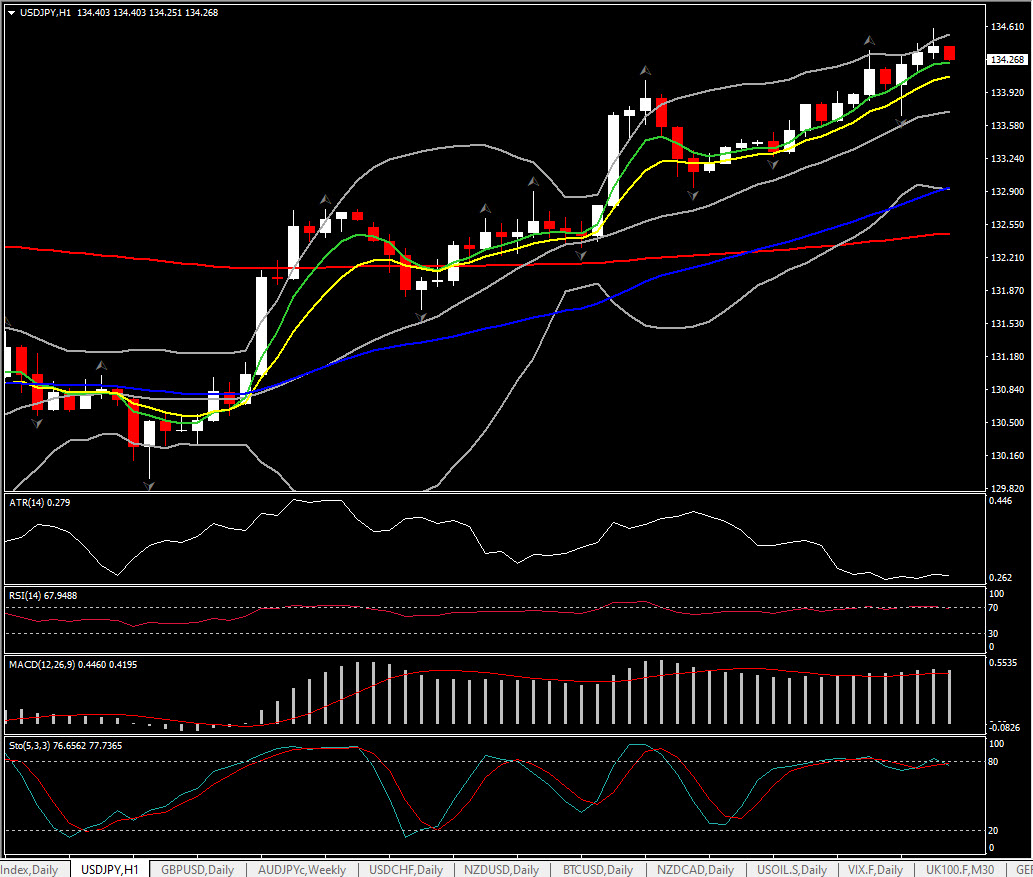

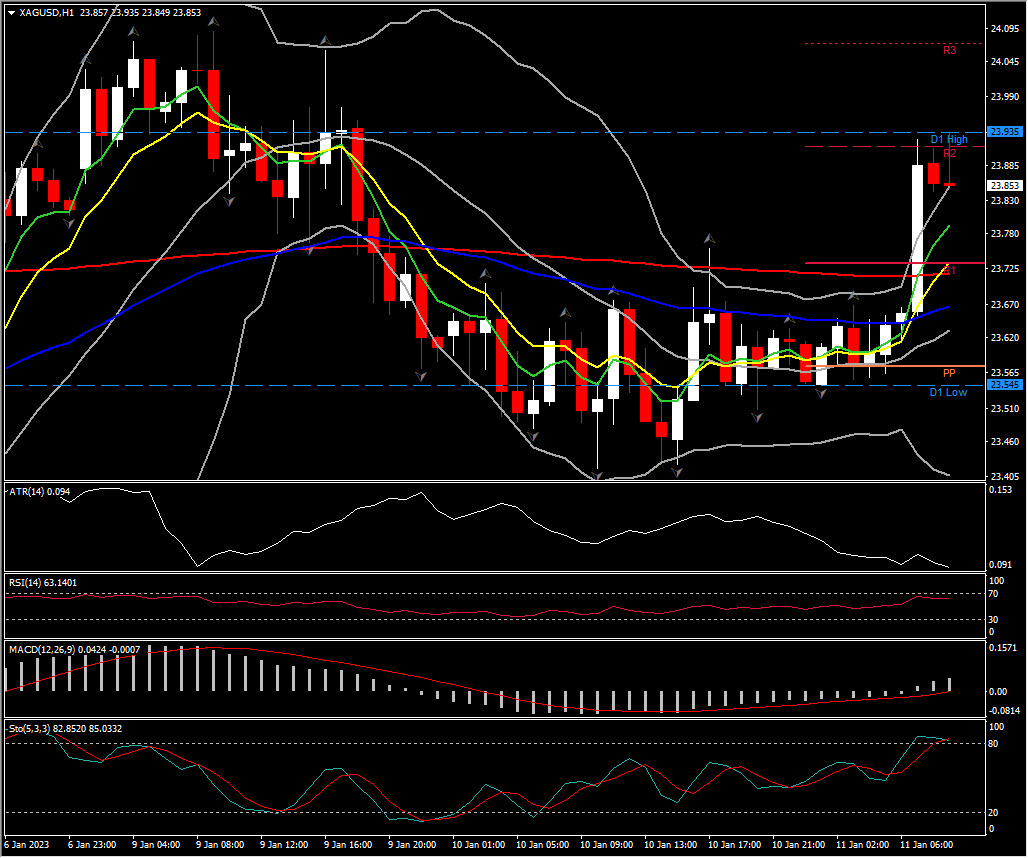

Biggest FX Mover @ (07:30 GMT) USDJPY (-0.59%). MAs aligned lower, MACD histogram & signal line negative and falling. RSI 37 & falling, H1 ATR 0.33, Daily ATR 1.93.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Market Update – December 19 – Covid outweighs Reopening.

- The USD Index is hovering around 104.00 bottom, despite the renewed rise in the Treasury yield. Global stock markets made a wobbly start to the final full trading week of 2022, with the prospect of interest rates rising further next year taking the edge off festive cheer, and with concerns over China Covid Outbreak. Asian yields dipped, while US Yields also held at lows as Treasuries continued to rise, 10yr is up 3.1 bp at 3.51%. Asian stocks have remained under pressure, with concern over China’s Covid count also weighing.

- China officially reported its first coronavirus-related deaths since the unwinding of some of the strictest pandemic control measures earlier this month.

- EUR – up at 1.0640 now & GBP stuck at 1.2160-1.22 area.

- JPY – extends lower to 135.80, with Yen be the biggest gainer of the day as speculation building that the Bank of Japan, which meets on Monday and Tuesday, is eying a shift in its ultra-dovish stance in future.

- Elon Musk asked Twitter users to vote Sunday on whether he should step down as head of the social-media platform and pledged to abide by the results. Plus Twitter said it would no longer allow “free promotion of certain social media platforms” like Meta Platforms Inc’s META.O Facebook and Instagram, Mastodon etc. on its sites.

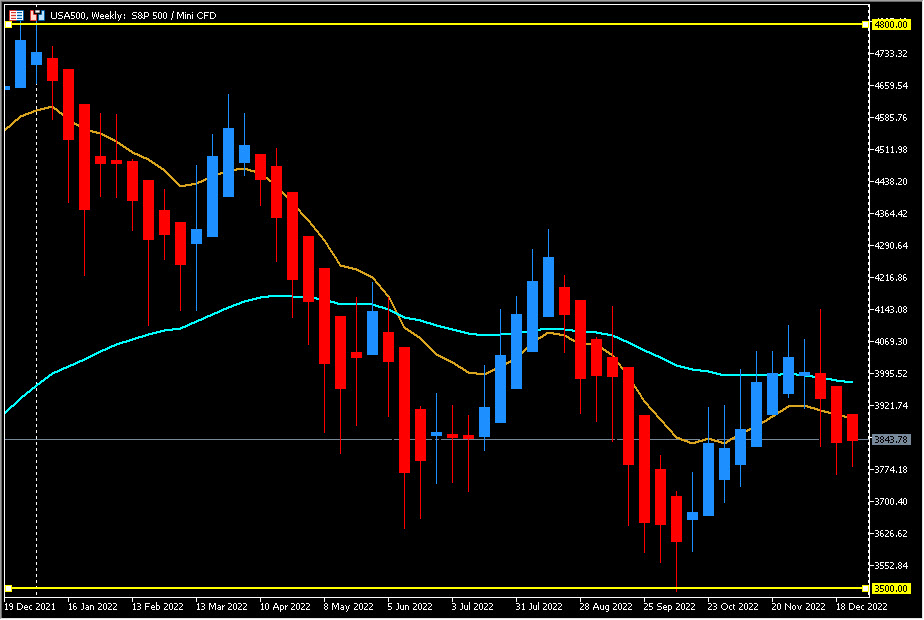

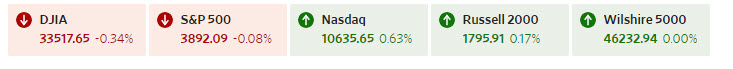

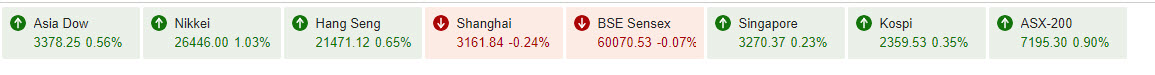

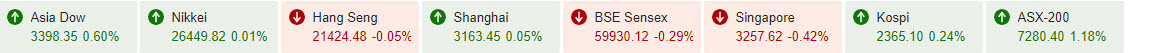

- Stocks – The JPN225 declined more than -1%. Hang Seng and CSI 300 are down -0.9% and -1.5% respectively. US500 dropped 2% last week (-20% for the year) while today US & European indixes are managing slight gains, US500 rose 0.1%.

- USOil – drifts to $74.65

- Gold – was steady at $1,793

- BTC – remained trading below $17,000.

Today: Germany Dec .Ifo survey, Eurozone Q3 labour market!

Biggest FX Mover @ (07:30 GMT) USDJPY (-0.59%). MAs aligned lower, MACD histogram & signal line negative and falling. RSI 37 & falling, H1 ATR 0.33, Daily ATR 1.93.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.