HFblogNews

Профессионал

Date : 17th November 2022.

Market Update – November 17 – “Recession is a threat”.

Recession is a threat, as suggested by the inverted yield curve, and some recent earnings reports, including Target today, reflect the various headwinds hitting the economy. Geopolitical risks from Ukraine are lingering too.

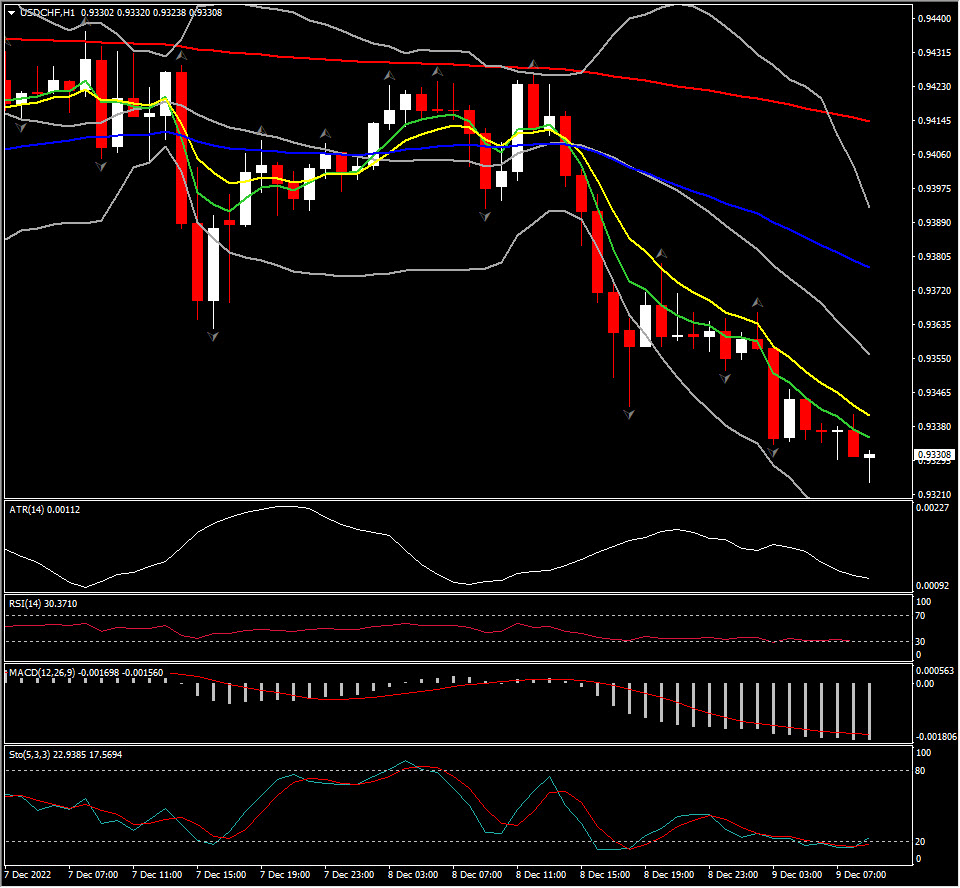

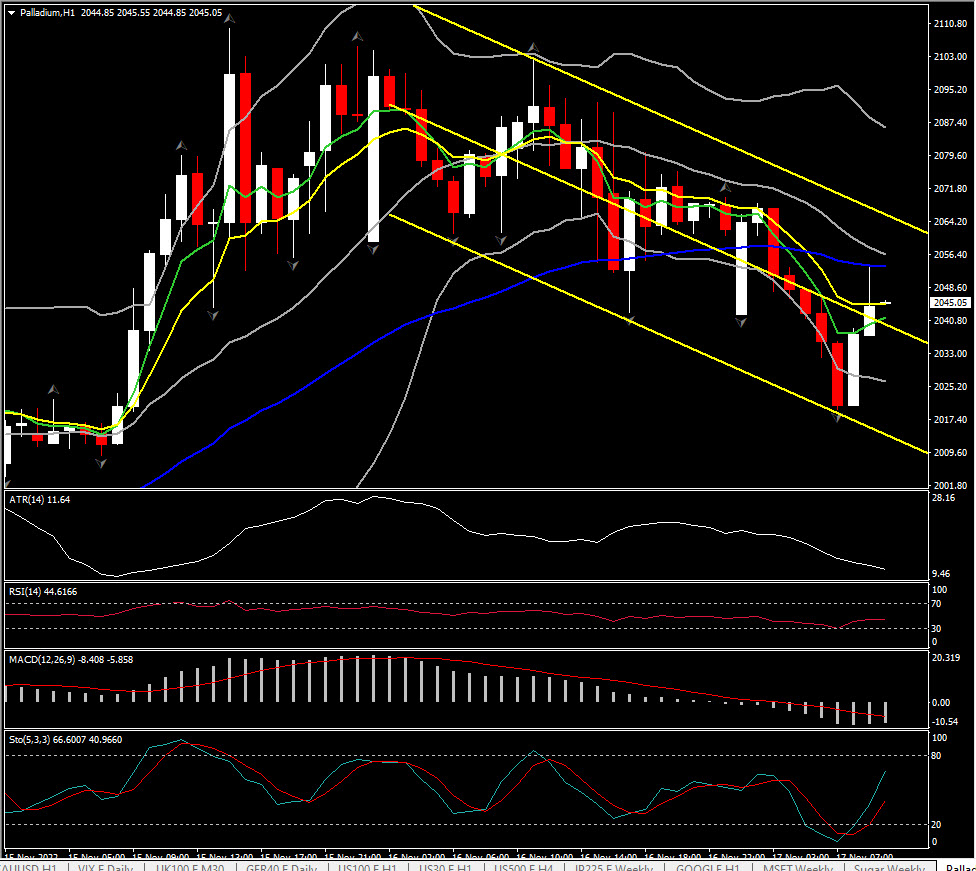

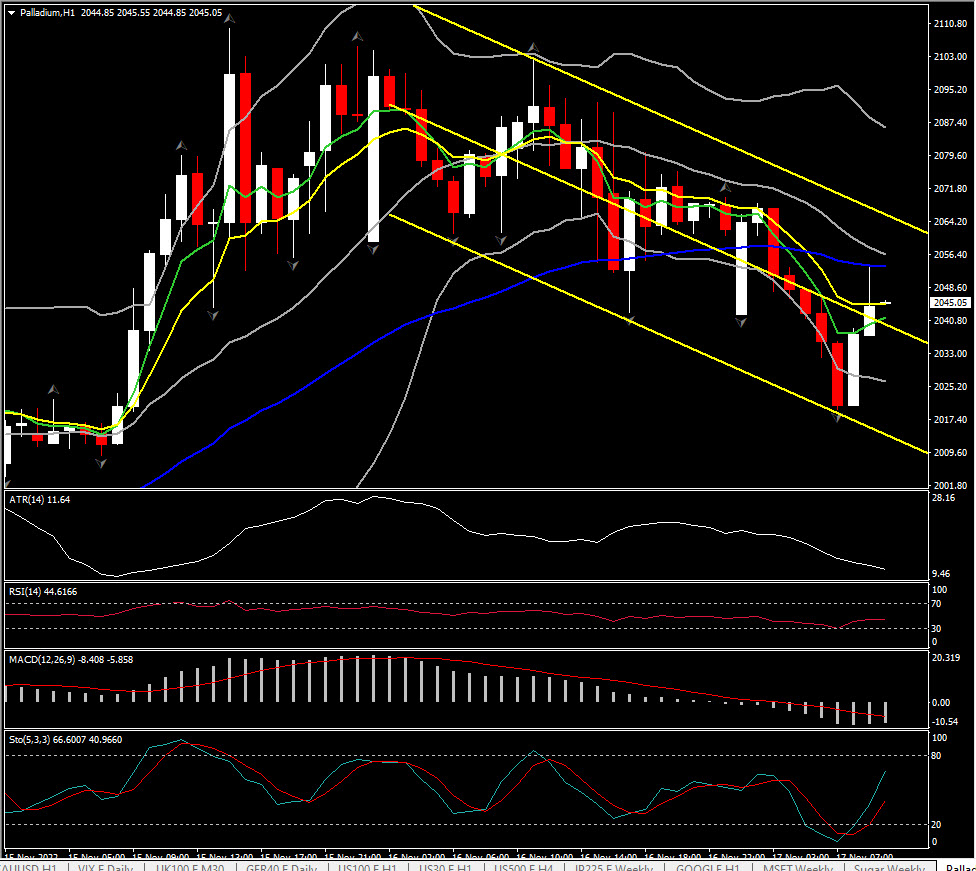

Biggest FX Mover @Palladium -0.90% (06:30 GMT) drifted to 2017 but rebounded this morning. MAs aligning flattened, MACD lines remain negative & RSI at 44 indicating that bearish bias holds. H1 ATR 11.64, Daily ATR 100.72.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Market Update – November 17 – “Recession is a threat”.

Recession is a threat, as suggested by the inverted yield curve, and some recent earnings reports, including Target today, reflect the various headwinds hitting the economy. Geopolitical risks from Ukraine are lingering too.

- The USDIndex’s steady 106.25 after ranging from 105.34 to 107.10. (heavy data calendar saw stronger than expected retail sales, weaker than forecast industrial production, with a further big drop in the NAHB) Yields close lower with, 10-year yield down 13 bps at 3.669%, after a high of 3.84%. The 30-year was 12.5 bps lower at 3.837%. The curve inversion deepened further to -68 bps, not seen since early 1981. Stocks

- Fed’s Waller: “more comfortable considering stepping down to a 50 bp hike“. But he added he will not be making that decision until he sees more data. Waller has been one of the most hawkish on the FOMC so these remarks are significant. VS Fed Daly repeated a pause in hikes is off the table for now and reiterated Chair Powell’s comment that it is not even a point of discussion currently, in a CNBC interview.

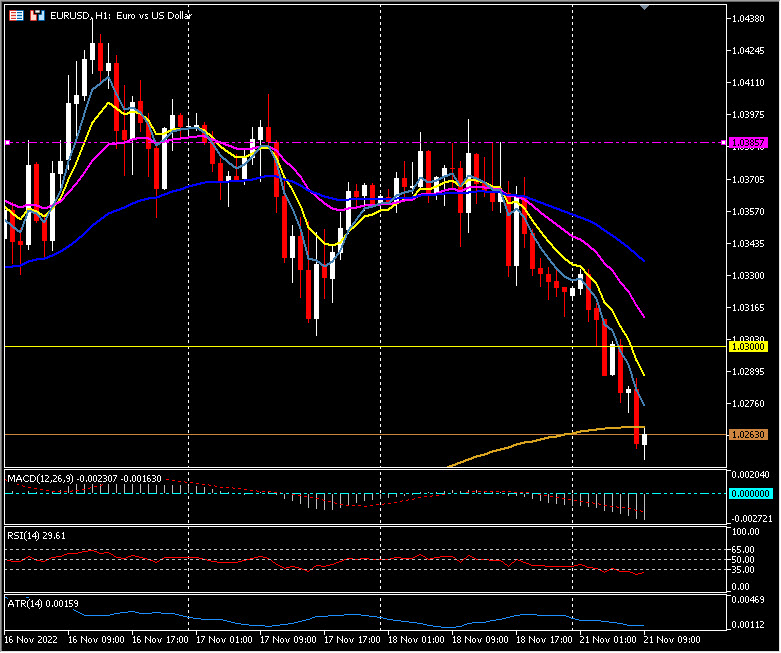

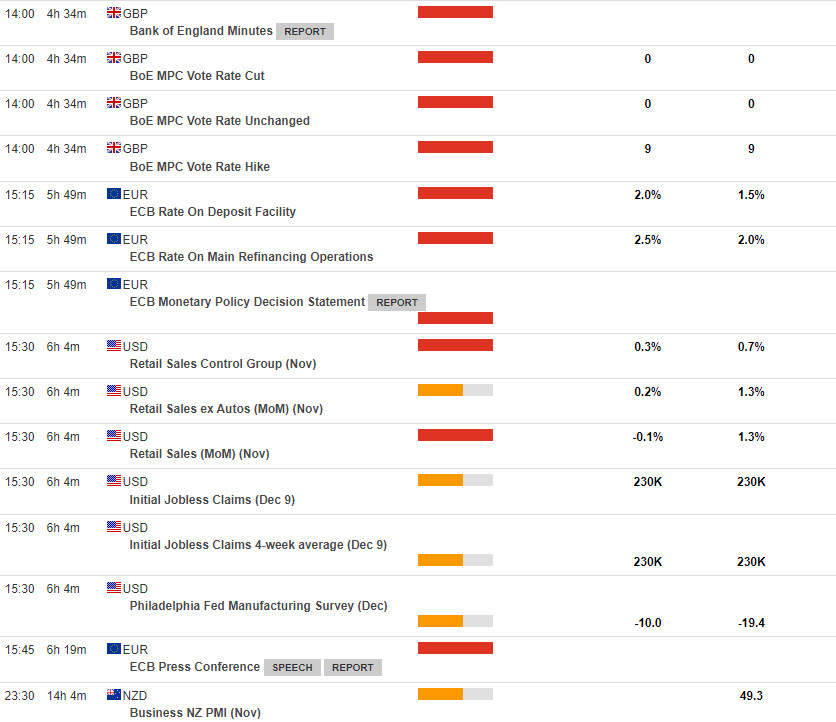

- EUR – choppy at 20-day SMA. Bloomberg source story effectively confirmed that the ECB will slow its tightening cycle and deliver a 50 bp move in December.

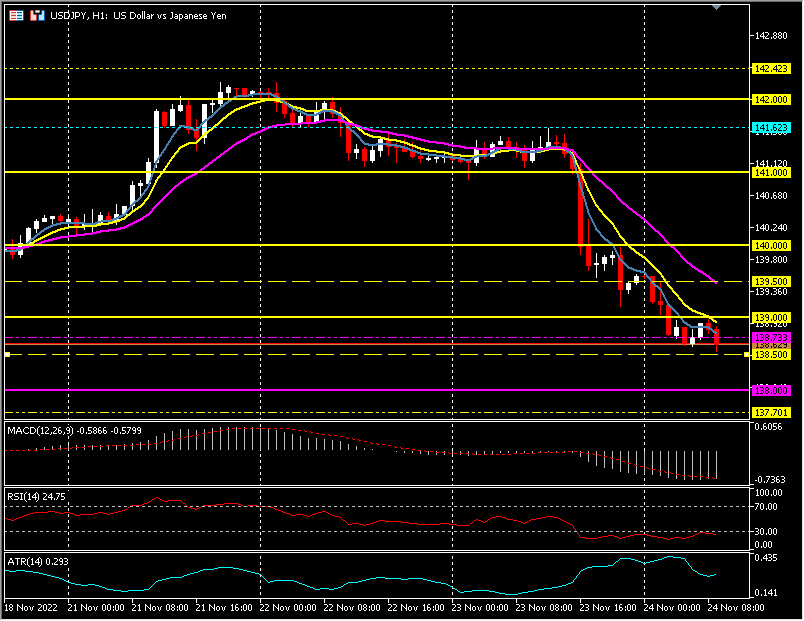

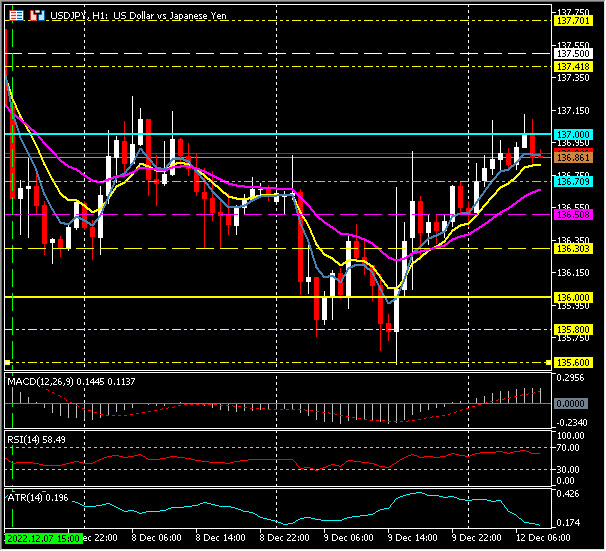

- JPY – holding below 140, but there is speculation that the correction in the dollar is running out of steam

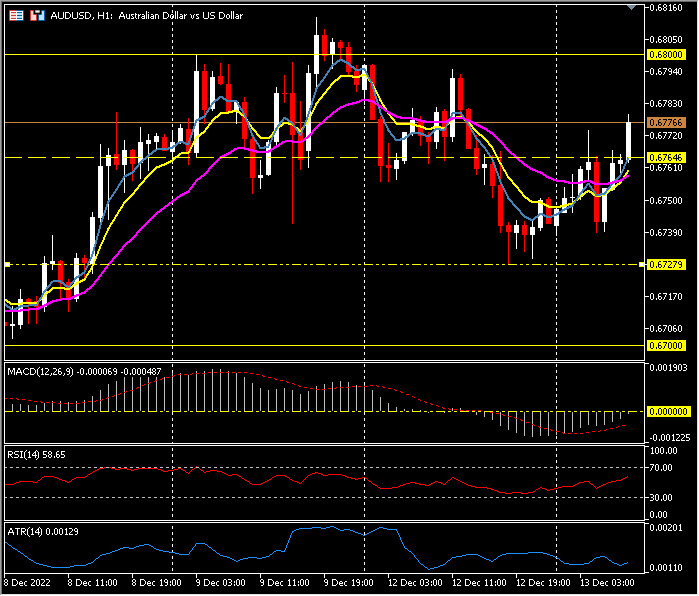

- AUDUSD holds gains above 0.6700 – Australia’s unemployment rate unexpectedly declined to 3.4%, employment lifted to a record high and part time employment declined. More signs of a tight labour market that will add to inflation concerns, especially after higher than expected data on wage growth yesterday.

- Stocks –Wall Street ended in the red with weakness concentrated in the US100 and the US500 following a very poor earnings report from Target. Nikkei and ASX closed narrowly mixed. PBOC warned that inflation may go higher as demand pickes up, with Hong Kong tech stocks most hit, by comments that dented hopes of further sizeable support from the central bank and Beijing officials for the economy. GER40 and UK100 are up 0.4% and 0.1% respectively.

- USOil – Energy weighed on the USOIL prices fell -1.88% to $85.29.

- Gold – drifted to $1760 on USD strength and pick up of Treasury yields.

Biggest FX Mover @Palladium -0.90% (06:30 GMT) drifted to 2017 but rebounded this morning. MAs aligning flattened, MACD lines remain negative & RSI at 44 indicating that bearish bias holds. H1 ATR 11.64, Daily ATR 100.72.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.